EMI Calculator with Breakdown

Calculate your EMI and visualize interest vs principal

What is EMI?

EMI stands for Equated Monthly Installment. It refers to the fixed monthly payment a borrower makes to a lender to repay a loan over a specified period. Each EMI includes both the principal amount (the actual loan) and the interest on the outstanding loan balance.

Whether you're buying a home, a car, or taking a personal loan, EMI allows you to repay your loan in manageable chunks instead of paying a large sum upfront.

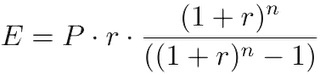

The Basic Formula for calculating Emi is :-

where

E is EMI

P is Principal Loan Amount

r is rate of interest calculated on monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term / tenure / duration in number of months

Example of EMI Calculation

Let’s say:

- Loan Amount (P) = ₹5,00,000

- Annual Interest Rate = 10%

- Tenure = 5 years = 60 months

- Monthly Interest Rate (R) = 10 / 12 / 100 = 0.00833

Now plug into the formula: EMI=500000×0.00833×(1+0.00833)60(1+0.00833)60−1EMI = \frac{500000 \times 0.00833 \times (1+0.00833)^{60}}{(1+0.00833)^{60} - 1}EMI=(1+0.00833)60−1500000×0.00833×(1+0.00833)60

EMI = ₹10,623 per month

How to Use an EMI Calculator? | Step-by-Step Guide

An EMI Calculator is a simple online tool that helps you estimate your monthly loan repayment (EMI) based on the loan amount, interest rate, and loan tenure. Whether you're planning a home loan, car loan, or personal loan, it helps you plan your finances smartly.

Steps to Use EMI Calculator Online

Follow these easy steps to use the EMI calculator effectively:

Select the Loan Type

Choose the type of loan you want to calculate:

- Home Loan

- Car Loan

- Personal Loan

This helps customize the fields and recommendations based on your selection.

Enter the Loan Amount (Principal)

Input the total amount you wish to borrow.

Example: ₹5,00,000

Make sure it matches your financial needs and eligibility.

Enter the Annual Interest Rate

Add the interest rate your bank or lender is offering.

Example: 8.5% per annum

You can usually find this in your loan offer or on bank websites.

Enter the Loan Tenure (in Years or Months)

Choose how long you want to repay the loan.

Example: 5 years (60 months)

A longer tenure means smaller EMIs but higher interest paid over time.

Click "Calculate"

Hit the "Calculate EMI" button. The tool instantly displays:

- Monthly EMI

- Total Interest Payable

- Total Loan Payment (Principal + Interest)

- Visual Chart (Pie Chart or Graph)